There’s never been a better time to plan for the unplanned

From planned to unplanned, the IG Living Plan Snapshot gives you a financial well-being score that shows how prepared you are. To find out if you’re on track, take the IG Living Plan Snapshot. After answering a few questions, you’ll receive a score for each dimension of your financial well-being. Your score and the accompanying recommendations can be used by you and an advisor to help you improve your financial confidence and well-being.

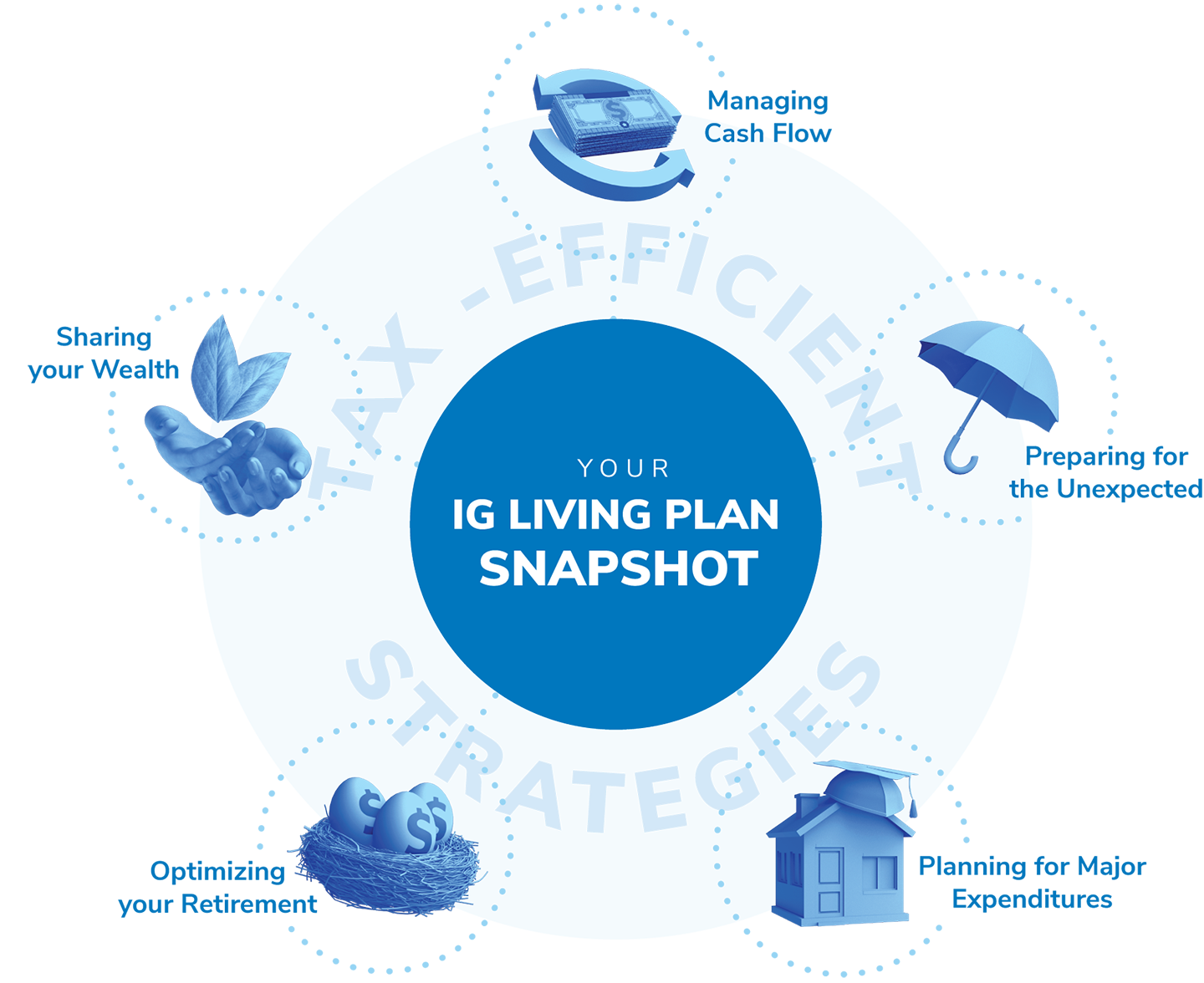

The IG Living Plan

We’ve developed the IG Living Plan, a holistic plan that considers your full financial life and looks at whether you’re saving enough, spending wisely, properly protecting yourself from the unexpected, while always considering how to maximize your tax efficiency along the way.

Optimizing your Retirement

Gain greater clarity and let us help you manage the risks of retirement, preserve your capital, and create income to help support your future lifestyle and goals.

Managing Cash Flow

We assess your cash and credit requirements and aid in optimizing your taxes to help you thrive during major life events, while working toward your goals.

Sharing your Wealth

Establish a well-constructed estate plan, tailored to your needs, that allows your legacy to endure by supporting the causes important to you.

Preparing for the Unexpected

Create comprehensive strategies that provide, preserve, and protect your loved ones and those you care for when the unexpected happens.

Planning for Major Expenditures

Ensure you have flexibility with a balanced plan that allows you to take advantage of opportunities and helps make your financial vision a reality.

Maximizing Business Success

Business owners can take full advantage and engage holistic strategies to synchronize and enhance your business and personal financial plan.

How strong is your financial plan?

From planned to unplanned, the IG Living Plan Snapshot gives you a financial well-being score that shows how prepared you are. You’ll answer a series of questions based on five dimensions of financial well-being and then receive a result out of 100 and recommendations on how best to meet your goals. Use these insights to create a comprehensive financial plan that evolves and adapts with your life.